Thank You!

Head to your email to get the Retirement Readiness Snapshot.

Don't see it?

Make sure to check it hasn't landed in your Promotions tab or spam folder by accident.

With the Retirement Readiness Snapshot, you’ll:

- Know if you’re ahead, behind, or right on track for the retirement you want

- Estimate how much you can spend each month in retirement

- Identify potential gaps between what you have and what you’ll need

- Feel confident about making informed decisions about your next steps

Why This Snapshot Works

✅ Built specifically for people with $500K-$1M saved

✅ Breaks complex retirement math into simple, actionable steps

✅ Uses time-tested principles to give you clarity

✅ Gives you concrete numbers rather than vague generalizations

✅Created by fee-only advisors who have helped hundreds of Northern Idaho families retire successfully

Perfect if you're...

Successful but uncertain

- You’ve done well saving, but you need to know if it’s actually enough for the retirement you want.

Ready for real numbers

- You’re tired of generic advice online and want to see how YOUR numbers actually play out.

5-15 years from retirement

- Close enough to need answers, but with time to adjust if needed.

Here’s what’s inside…

- Step 1: Estimate Your Monthly Spending. Calculate what you’ll actually spend based on your lifestyle and goals.

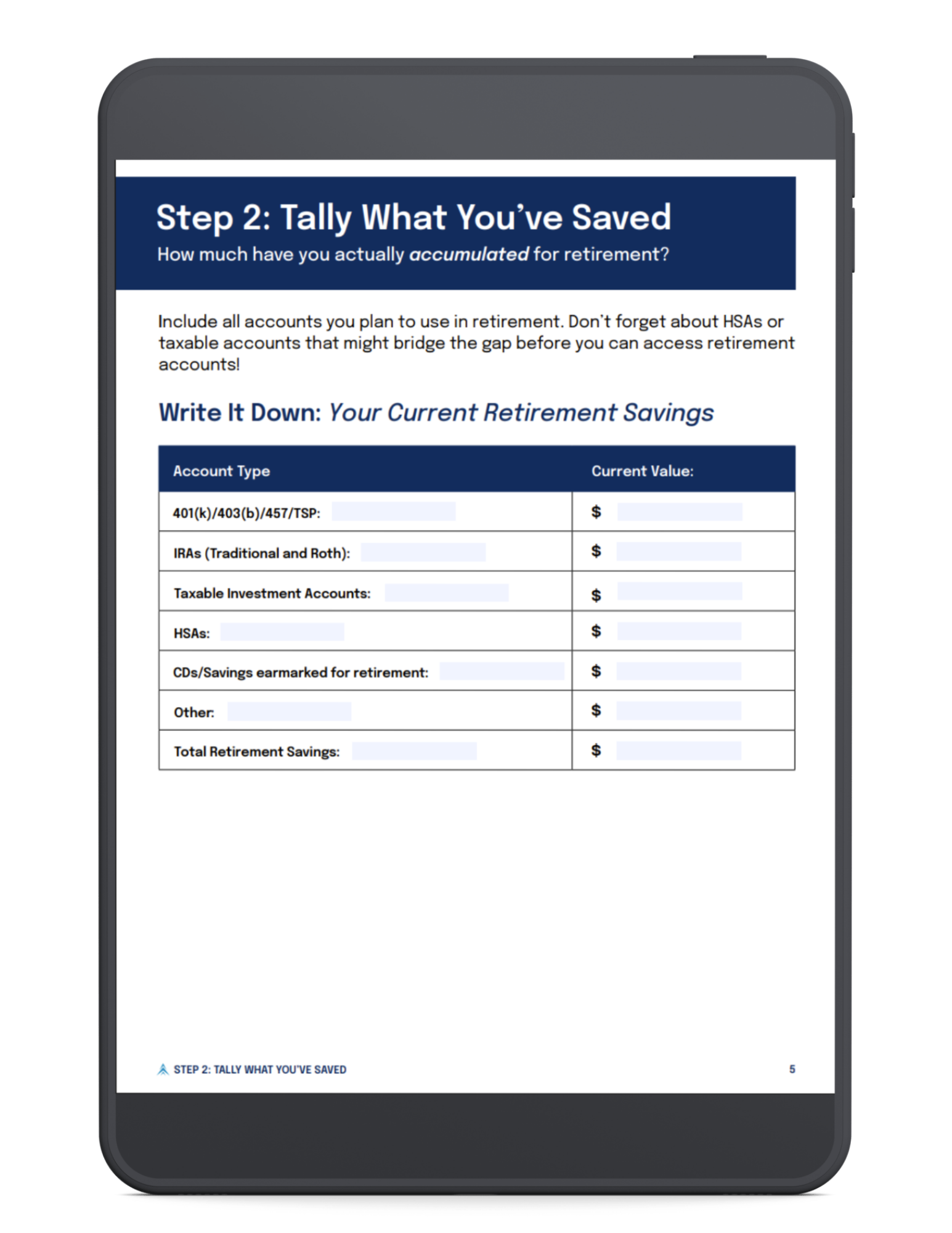

- Step 2: Tally What You’ve Saved. See all your retirement savings in one clear view.

- Step 3: Identify Your Income Streams. See how Social Security, pensions, and other income can take the pressure off your portfolio.

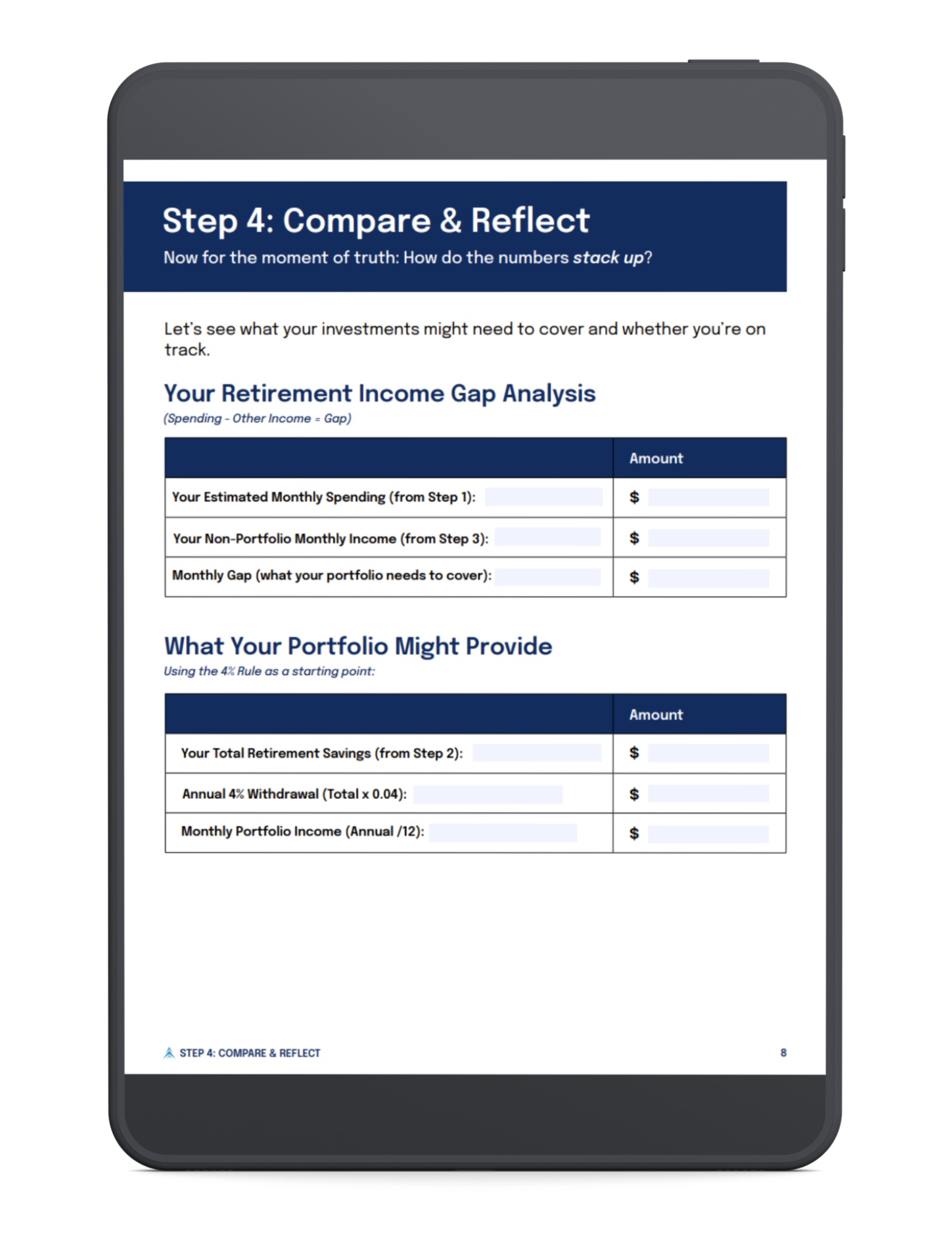

- Step 4: Compare & Reflect. Find out if you’re ahead, on track, or what needs attention.

PLUS:

Reflection questions throughout to help you think through what the numbers really mean for YOU.

Thank You!

Head to your email to get your Retirement Readiness Snapshot.

Your information is secure and will never be shared. Unsubscribe anytime.

This guide is provided as an educational resource by Five Pine Wealth Management, a fee-only fiduciary advisory firm dedicated to helping clients make confident financial decisions.